THE SMARTER WAY TO DCA ONCHAIN

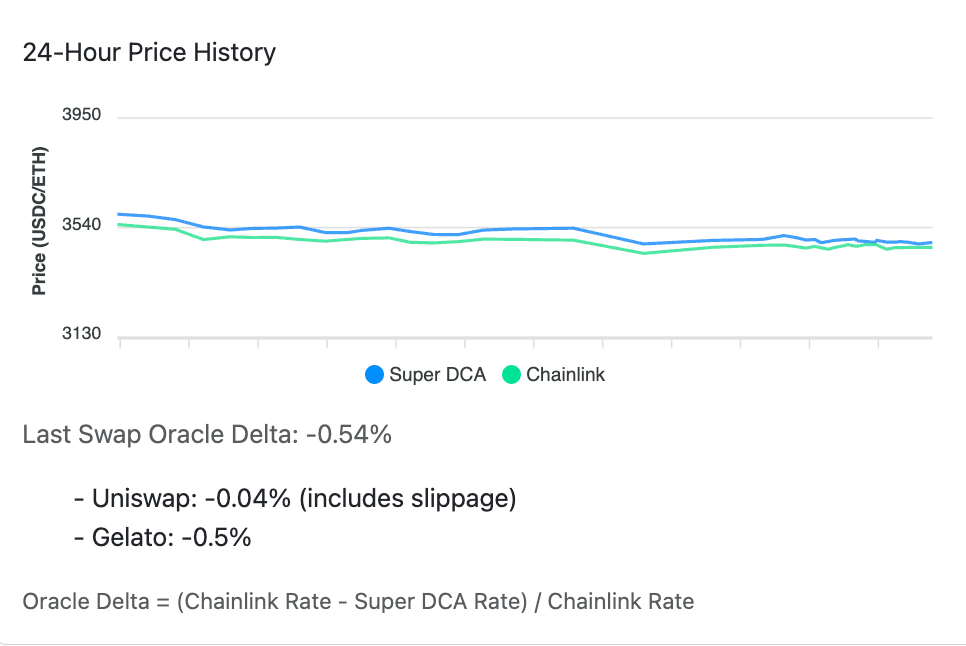

Stop over-paying for "recurring buys." Super DCA delivers institutional-grade execution with an average loading... relative to Chainlink in the last 24 hours.

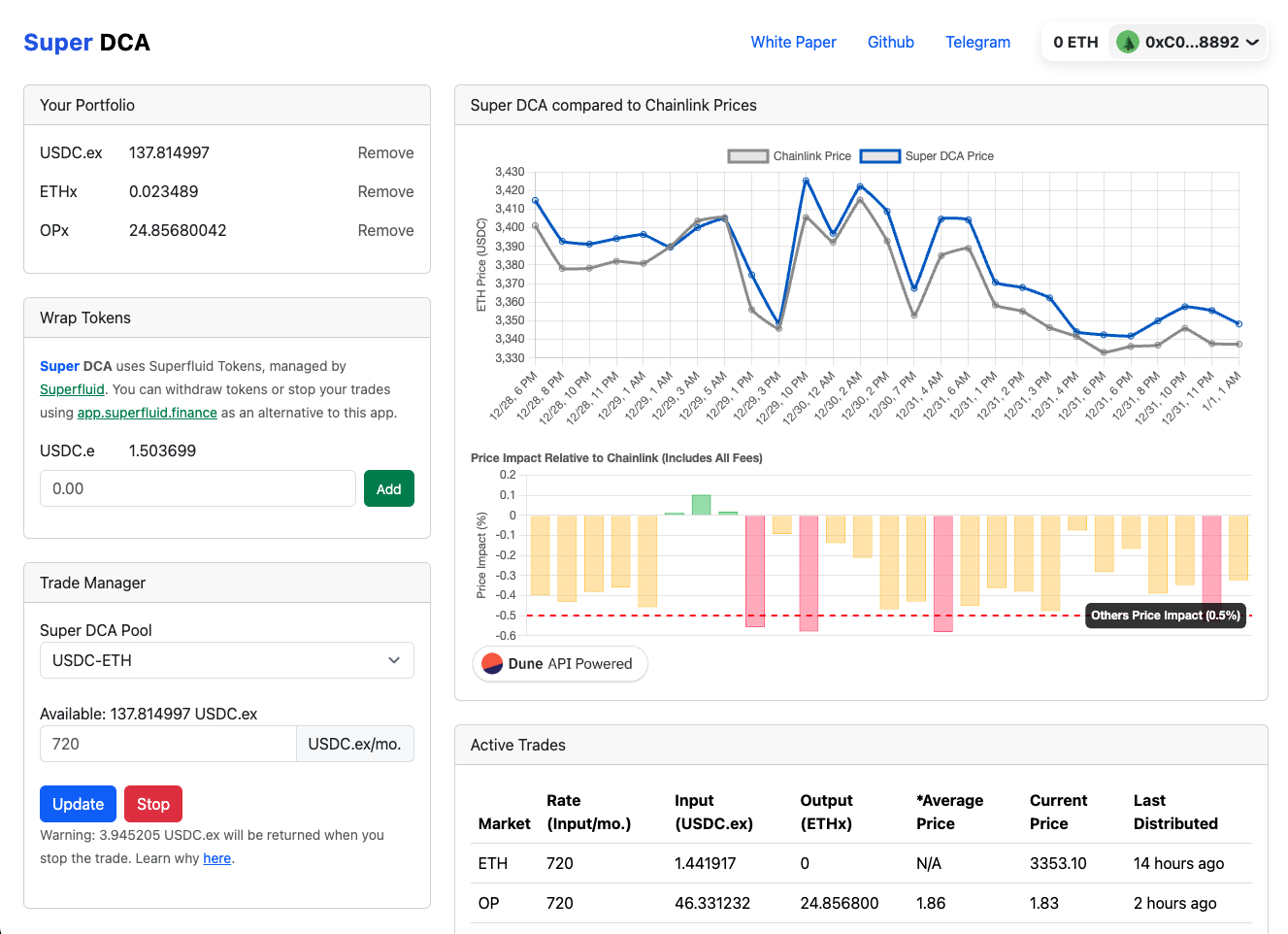

PROOF OF PRICE IMPACT

Super DCA provides complete transparency into every trade's price impact. Our Chainlink integration lets you verify the true cost of your DCA strategy in real-time.

Track our performance against Chainlink price feeds and see how we consistently deliver better execution than traditional DCA platforms.

Dollar Cost Average Cost Comparison

Super DCA is leading in the race to the bottom by eliminating fees, not just lowering them.

| Platform | Swap Fee | Spread | Annual Cost |

|---|---|---|---|

| ★ Super DCA | 0% | loading... | loading... |

| Robinhood | 0% | 0.35% | $4.20 |

| Kraken | 1.50% | - | $18.00 |

| Coinbase | 1.49% | 0.50% | $23.88 |

| Gemini | 1.49% | 0.50% | $23.88 |

Super DCA Spread based on average oracle delta over 24-hours on 2025-06-15. Annual Cost calculated at $100/month.

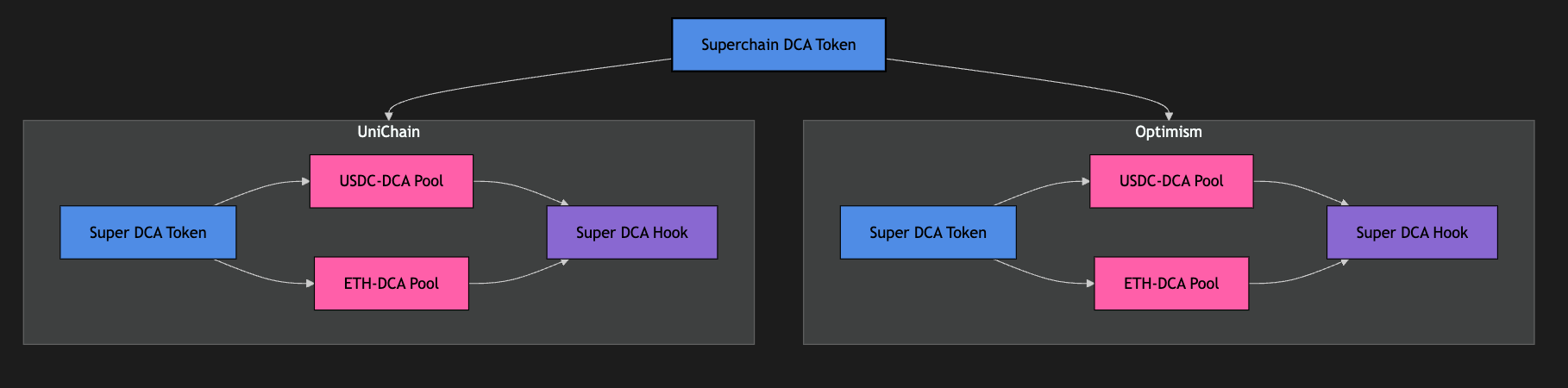

How Super DCA Works

A simple three-step process to try Super DCA today on Optimism:

Deposit to Superfluid

Upgrade USDC to Superfluid USDC to start trading.

Set Your Super DCA Rate

Select the token to buy and agree to a rate (USDC per month) of to buy it at.

Automatic Execution by Gelato

Uniswap V4 will automatically fill your trades every few hours, with execution by Gelato.

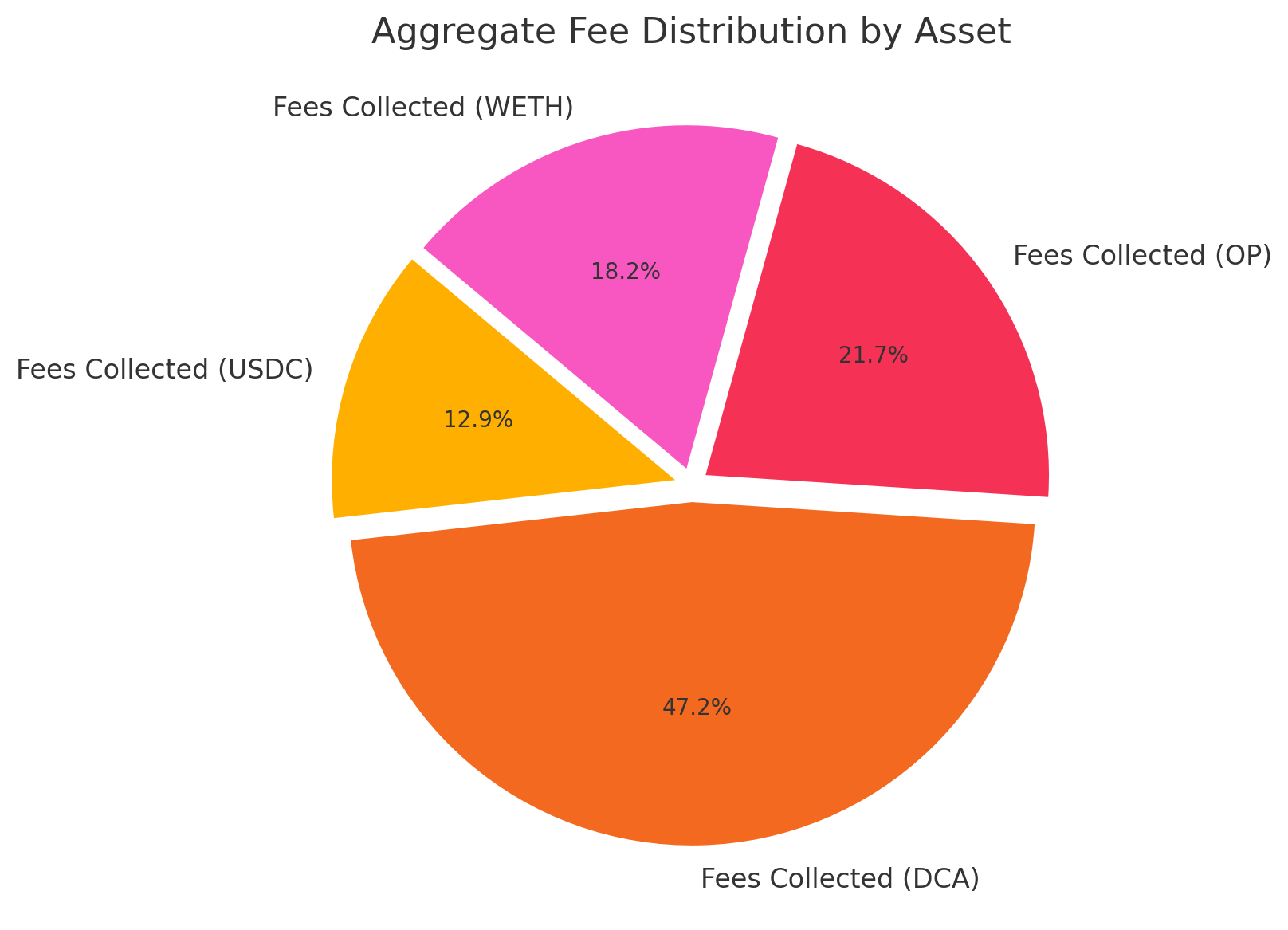

Super DCA Liquidity Network - Total Value Locked

Join our liquidity providers across multiple chains and earn DCA token donations from Uniswap V4 Liquidity Pools on Optimism, Base, and Unichain.

Our Supporters

We have received grants for our research from the following organizations

Our Research

Read our publications on the Token Engineering Commons Forum

April 2025

Super DCA Joins the Superchain App Incubator

READ MORE →

January 2025

Super DCA's Uniswap Integration Live on Optimism

READ MORE →

December 2024

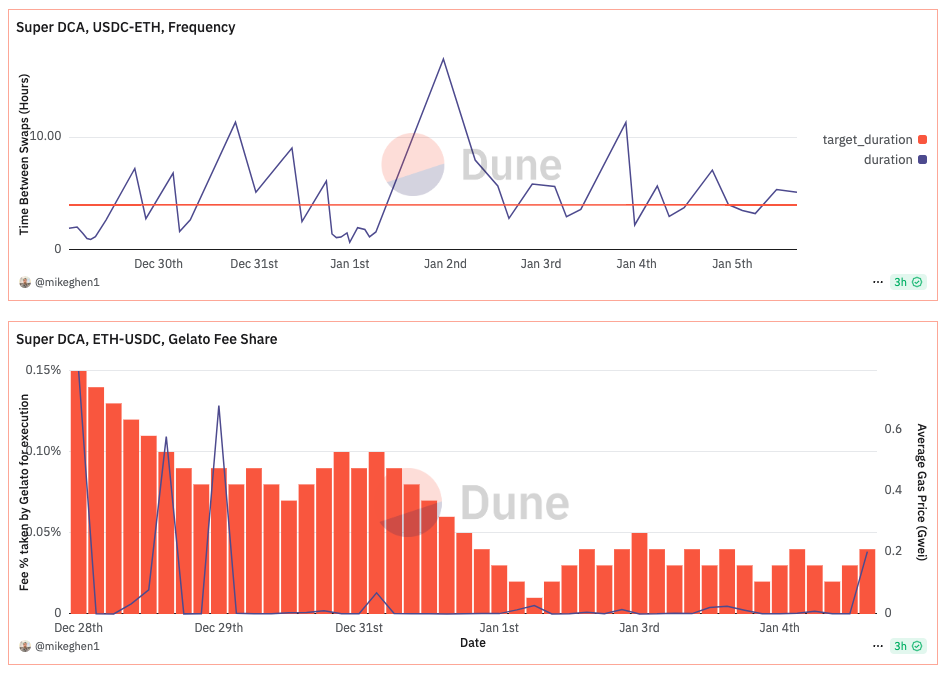

Evaluating the Super DCA Liquidity Network on Optimism: Performance Insights and Key Metrics

READ MORE →

November 2024

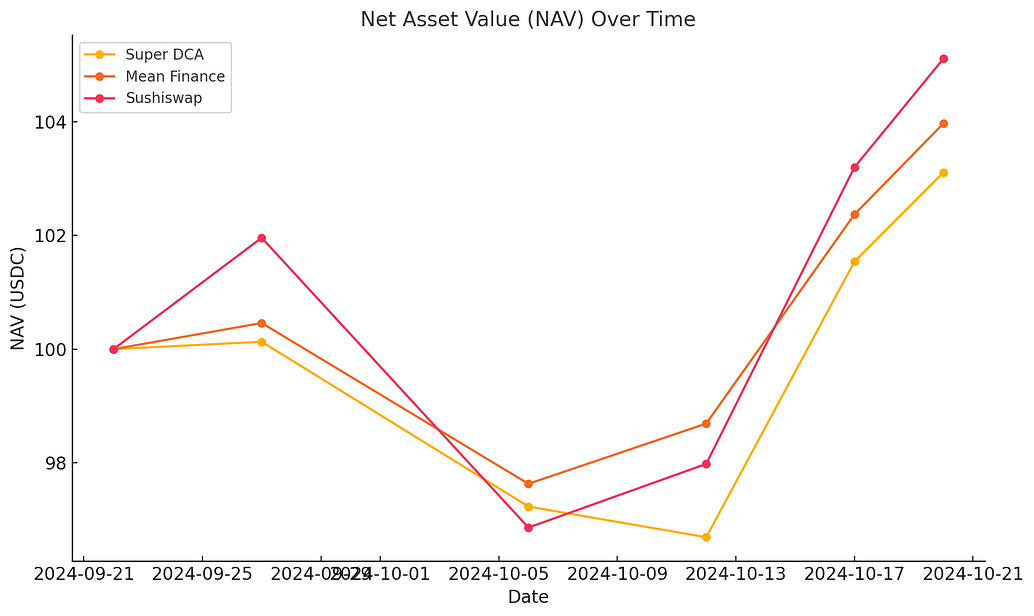

Benchmarking Super DCA Against Leading DCA Platforms: A Comparative Analysis

READ MORE →

August 2024

BUY DCA

BUY DCA BUY DCA

BUY DCA BUY DCA

BUY DCA